Wednesday, 5th August ’20

Good morning, welcome to another energetic and bright day. Monsoons are in full swing in India. Today is very significant in the history of the evolution of AI. Firstly, in 1997, Deep Blue, IBM’s supercomputer, beat the world champion, Garry Kasparov, at chess. Second, in 2016, an Artificial intelligence algorithm developed by Google beat a human at Go, a Chinese board game that’s tougher than chess. These two milestones in AI marked significant milestones indicating the future of technology.

Here is a popular quote from scientist Stephen Hawking on AI.

Computers will overtake humans with Ai in the next 100 years. When that happens, we need to make sure the computers have goals aligned with ours.

MARKETS

- Markets: BSE Sensex recouped after 4 days on Tuesday ending in green. Traders speculate if this growth will sustain. Sun Pharma launched COVID drug Favipiravir at Rs 35 a tablet as the COVID cases continue to scale. This could help spark optimism in the pharma sector. The global cues continue to be negative as US lawmakers struggled with a new stimulus package. Profit booking continues in Index heavyweight Reliance for the second day. Experts advise investors to remain defensive in their portfolio approach.

TECHNOLOGY & INNOVATION

DST Global, the investment firm headed by billionaire Yuri Milner, is close to investing as much as $400 million in Byju’s, valuing the startup at $10.5 billion – only second behind Paytm in valuation. DST has also backed Flipkart, Ola, Swiggy, and Udaan previously. Byju’s is profitable and its revenues doubled to $373 million this year.

NPCI has told RBI that WhatsApp Pay has complied with all data localization parameters that were needed before it could launch its payment services in the country. They are therefore giving ICICI Bank (PSP bank for WhatsApp) the approval to go live. The supreme court will give a final verdict now.

“Marketing Cloud”, a popular concept in the world of marketing tech, is used to describe the digital toolsets for organizations to identify and connect with customers. Yotpo, an Israeli-American startup that offers marketing cloud services, including SMS and visual marketing, loyalty and referral services, and reviews and ratings, has raised $75 million.

WHAT ELSE IS COOKING

Google buys $450 million stake in ADT to extend Nest’s reach: Google is paying $450 million for a nearly 7% stake in longtime home and business security provider ADT Inc. – a deal that will open new opportunities for one of the internet’s most powerful companies to extend the reach of its Nest cameras and voice-activated voice assistant. As part of the partnership, ADT will use Nest’s internet-connected cameras, as well as Nest Home Hub that comes with an internet-connected camera, as part of its customers’ security systems.

China calls US “bully” over TikTok ops sales: China accused the United States of “outright bullying” over popular video app TikTok after President Donald Trump ramped up pressure for the US operations to be sold to an American company. Trump said that Microsoft was in talks to buy TikTok, which has one billion worldwide users who make quirky 60-second videos with its smartphone app. This has caused dissent from popular TikTok stars in the US.

Mutual Fund platforms tie-up with Amazon to offer saving products to customers: The online mutual fund platforms have prescribed a ₹90,000 limit, as they are accepting payments via UPI, which has a ₹1 lakh limit per transaction. Orowealth and Kuvera, two online mutual fund platforms have launched savings products that offer a 3% bonus on Amazon Pay Gift Cards.

IN-DEPTH ANALYSIS

Tata Communication’s New Enterprise Platform for post-COVID workplaces

Why is it in the news?

Tata Communications has launched a new platform to help enterprises adapt and rebuild their organizations in a post-COVID-19 world.

What are the key highlights?

- The ‘Secure Connected Digital Experience’ (SCDx) will help companies by providing a solution that helps with various aspects like contactless experiences for employees and supply chain partners, shift to digital commerce, and a digital workplace solution.

- The new solution will offer enterprise-grade collaboration and security solutions, ensuring that dispersed teams can collaborate without compromise, as well as secure access to applications behind enterprise firewalls to boost innovation, productivity, and efficiency.

- The digital customer experience platform will help recreate the in-store experience for b2x companies and will enable the supply chain ecosystem with secure access to core enterprise applications.

- It will provide secure and high-performance, zero-trust network access (ZTNA) through a partnership with NetFoundry, a subsidiary of Tata Communications.

MANAGERS’ CORNER – Finance with TMT

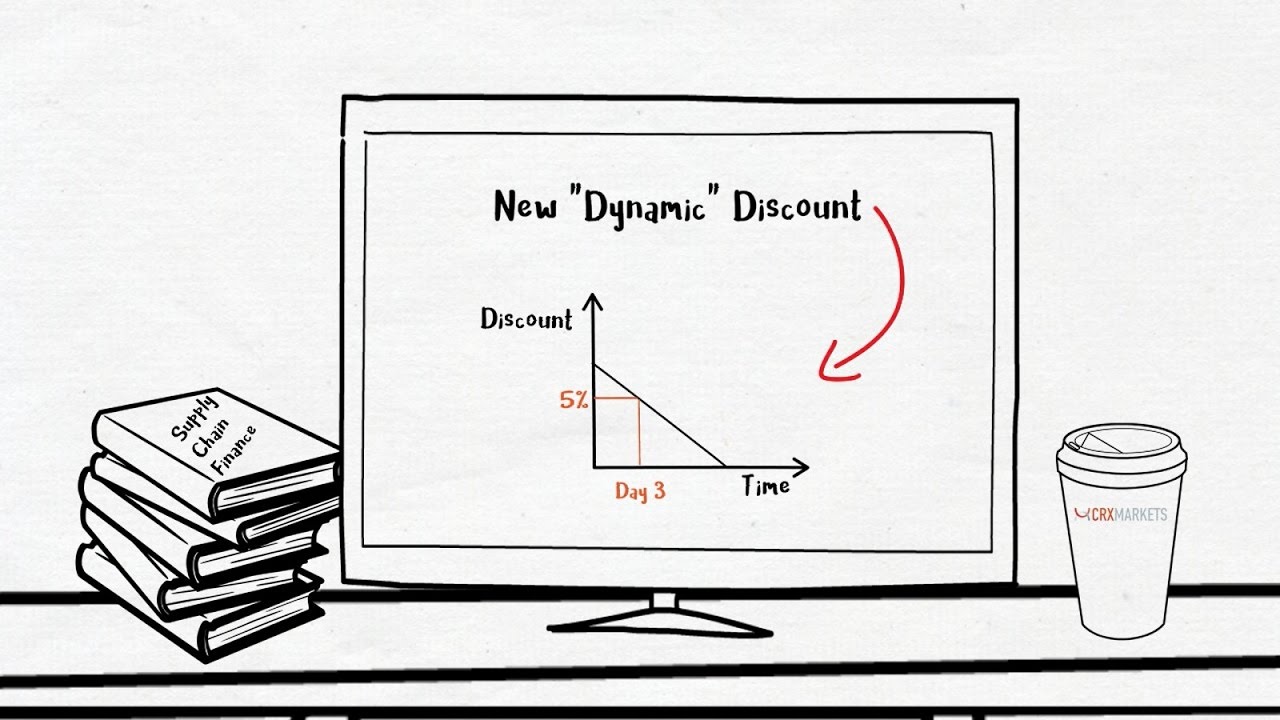

Dynamic Discounting is a form of supplier financing that puts your surplus cash to better use. Suppliers can take early payment in return for a discount. It allows both parties to view invoices through a web-based platform and select approved invoices for early payment.

Your suppliers choose which invoices to accelerate according to their cash flow needs. They can take payment any time between invoice approval and maturity. The earlier the payment, the greater the discount.

Benefits to Buyers

Buyer can use their own balance sheet or excess cash to generate additional purchasing discounts.

Maximize savings from early payment discounts. Hard savings go straight to their bottom line, which can be invested further, and improve profitability.

By injecting liquidity into the supply chain, buyers can strengthen their suppliers and become their customer of choice.

Benefits to Suppliers

Supplier benefits by reducing working capital and getting paid earlier.

Suppliers have access to consistent funding that typically comes at a much lower cost than other financing options.

Suppliers are better placed to invest in innovation and business growth and thereby benefit end consumers.

THE MILLIONAIRE MINDSET

Company of the day: Softbank group

SoftBank Group Corp. operates as a holding company which engages in the management of its group companies. It operates through the following segments: SoftBank, Sprint, Yahoo Japan, Distribution, Arm, SoftBank Vision Fund and Delta Fund, and Brightstar.

The popular Vision fund is a $100 billion venture capital fund.

Softbank has backed or bought a number of established firms like Nvidia, the We Company, Slack, Uber, and ARM. Other major backings include internet firm OneWeb, PayTm, and farming startup Plenty.

The man behind the phenomenal success is Masayoshi Son. Son is a self-made billionaire with a flair for entrepreneurship from his young days. Son was convinced early on that technology is the future and created an electronic transistor and sold it to Son Corporation for $1.7 million. He was an early investor in Yahoo and Alibaba. With a 29.5% stake in Alibaba, the total value of Softbank’s investment at Alibaba is at $108 billion.

Written by Kumar Sourav Mohanty, Akansh Bhatt, and Shashank Dobhal

Become Smarter in Just 5 minutes

Get a daily mail that makes reading the news enjoyable. Stay informed and entertained for free. (After Sign Up, you’ll receive a welcome mail within 5 minutes. If you don’t get it, check your promotions tab and move it to primary.)

FOLLOW US HERE