Wednesday, 1st July ’20

Good Morning! On this edition, we have specially curated the freshest and most impactful news, to help you jumpstart your day. Read further to know what Fitch said about India’s FY22 growth outlook, which Industry majors pledged support to B2B startups, funding updates from the startup world, and which company is RIL set to acquire.

Also, on this day, in 1979, Sony released its first walkman, a cassette player which was portable. It was not only a breakthrough in technology but also a breakthrough in imagination. It’s this imagination that has driven innovation in every field, from music to business. We hope this newsletter does its bit to ignite that imagination in you.

MARKETS

- ONGC reports its first ever quarterly loss. ONGC posted a net loss of Rs. 3098 crores in Q4, hit by the impairment due to slump in oil and gas prices. The Oil and Gas company also took a hit due to a 20% YOY decline in revenue from operations, totalling Rs. 21456 crores. The stock prices of the company, over the past one year has corrected by almost 50%, and fell by 36% during the period Jan-Mar’20.

- India’s fiscal deficit reaches 59.8% of annual target in Apr-May. India’s fiscal deficit stands at Rs. 4.66 trillion in two months. The net tax receipts and total expenditure was Rs. 33850 crores and Rs. 5.12 trillion respectively. The recent numbers suggest that the government is front loading its budgeted spends to counter the economic impact of lockdownd due to Covid-19.

- Bharat Dynamics stocks rallies 16% after 149% increase in Q4 profits. The company reported a net profit of Rs. 309 crores in Q42020 as compared to Rs. 124 crores in the year ago quarter. The leading defence PSU saw the operational income rise by 64% to Rs. 1435 crores.

- Fitch cuts India’s FY22 growth projection to 8%. Fitch ratings cut India’s growth projection for 2021-22 fiscal to 8% as compared to 9.5% projected last month. Fitch proposed the cut at the back of stringent lockdown norms, limited policy easing response, and ongoing financial sector fragilities. It however, retained its earlier projection of Indian economy contracting by 5% in FY21.

TECHNOLOGY & INNOVATION

- Former Andreessen Horowitz general partner Balaji Srinivasan has backed Indian startups working to fill the gap left by the banning of Chinese apps. Hinting at possibly investing in a company he likes, Srinivasan added that smart Indian teams will do to China what China did to the US for many years: namely, clone every feature of the now-banned Chinese apps unapologetically. AngelList founder Naval Ravikant has shown interest too.

- Microsoft and Accenture have pledged their resources and support to B2B startups working on supply chain resilience, channel shift to digital commerce, systems resilience and responsible technology. The 100X100X100 program from Microsoft and the Accenture venture challenge have come together to help startups evolve from being market-ready to enterprise-ready.

- Oracle opens 2nd Cloud region in Hyderabad, India to help firms stay afloat during this difficult period. Oracle’s autonomous suite will strengthen capabilities for business continuity and disaster recovery. The enterprise grade gen 2 cloud region will provide enterprise customers in India better performance, pricing, and security apart from streamlining their path of digital transformation.

- AWS today announced that CodeGuru, a set of tools that use machine learning to automatically review code for bugs and suggest potential optimizations, is now generally available. These tools are a barometer for best practices while using an AWS API or SDK. Reviewer analyzes existing code bases in the repository, identifies bugs and issues. Profiler then uses machine learning to automatically identify code and anomalous behaviors that are most impacting latency and CPU usage.

PRODUCTS & STARTUPS

- Samosa Party, an Indian go-to snack solution has raised an undisclosed seed amount from Inflection Point Ventures. They serve 14 different varieties of Samosa in Tier 1 cities. This investment will help them scale and open other cloud kitchens. According to the startup, the Indian snack market is pegged at Rs 42 lakh crore with 65% of it unorganized.

- Bold Care, a Mumbai based health and wellness startup has raised an undisclosed pre-seed amount from Fung Strategic investments, Abhishek Shah, Founder of Consumer X, and other strategic investors. They aim to help their consumers in their digital health with andrology, fertility, and urology as a few focus areas.

- Hunters, a Tel Aviv based cybersecurity firm has raised $15 million in its Series A funding round from Microsoft’s M12 and US Venture Partners. The company is a SAAS platform to automate threat hunting to detect stealth attacks.

WHAT ELSE IS COOKING

PM GKAY bestows upon 80 Cr Indians free rations till Diwali: During Prime Minister Modi’s 30th June address, he broadened benefits under his flagship Garib Kalyan Yojana to deliver free rations to 80 crore Indians under the program, costing around 90 thousand crore rupees. He also mentioned that as per the package of INR 1.75 lakh crore announced under Garib Kalyan Yojana, during the last 3 months, 31000 Cr has been deposited in the Jan Dhan accounts of 20 crore poor families. The announcement comes abreast the second phase of Unlock the country is entering into.

Beijing sends its first reaction to India’s ban on 59 Chinese linked apps: The month of June ended with a surprise take by India banning 59 Chinese linked apps just days after Chinese social media app WeChat (also banned by India) removed updates by the Indian Embassy on the border issues. Such a knee-jerk reaction by India stimulated a grave response from the Chinese Foreign Ministry which said that it is “strongly concerned” about the take of New Delhi and underlined that it won’t serve the “Indian interests”. TikTok CEO, Nikhil Gandhi has also issued a statement that they will verify the situation with the concerned authorities.

RIL’s inorganic growth spree adds one new chapter: The Ambani-led conglomerate is near to acquire the retail business of Kishore Biyani’s Future Group. It will fortify RIL’s establishment across categories like groceries, fashion and general merchandise. Prior to the acquisition, Biyani’s Future Retail, Future Lifestyle Fashions and Future Supply Chain Solutions will see a merger among themselves. The nearest date of deal closure is apprehended to be before July 15. At present, Future Retail has over 1500 stores including brands like Big Bazaar, Nilgiris , Easyday while Future Lifestyle has 300 stores through brands like Central and Brand Factory.

International Flights to resume in phase during Unlock 2.0, govt. announces: The much awaited announcement from the Home Ministry finally arrived. The international passenger travels will commence in a phased manner during ‘Unlock 2.0’ after July 15. The Director General of Civil Aviation further added that the flights will take up on “selected routes on a case-to-case basis”. However, Indian government has been repatriating stranded citizens from over 50 countries through air under the Vande Bharat Mission and nearly 1,25,000 Indians have returned from different countries.

MORNING TEA LISTICLES

Well, 2020 has not been a call-out year for investors in funds. However, there are sentiments that run positive for the later half of the year. So, in case your decision is worth taking a risk and you are optimistic, we would help you with PaisaBazaar’s top 5 Equity Funds to invest, measured according to their financial goals, risk tolerance, fund performance, assets under management and costs, managerial expertise and direct funding capacity.

- Axis Bluechip Fund: Large Cap fund with Rs. 12,717 Cr assets under management, 8.25% 3-year returns and 8.75% 5-year returns.

- Axis Small Cap Fund: Small Cap fund with Rs. 2,169 Cr assets under management, 2.20% 3-year returns and 7.54% 5-year returns.

- Motilal Oswal Midcap Fund: Mid Cap fund with Rs. 1,415 Cr assets under management, -7.81% 3-year returns and 1.94% 5-year returns.

- DSP Tax Saver Fund: ELSS with Rs. 5,407 Cr assets under management, -1.01% 3-year returns and 6.5% 5-year returns.

- SBI Magnum Global Fund: Thematic fund with Rs. 3,508 Cr assets under management, 2.92% 3-year returns and 5.08% 5-year returns.

BOOKS AND MOVIES

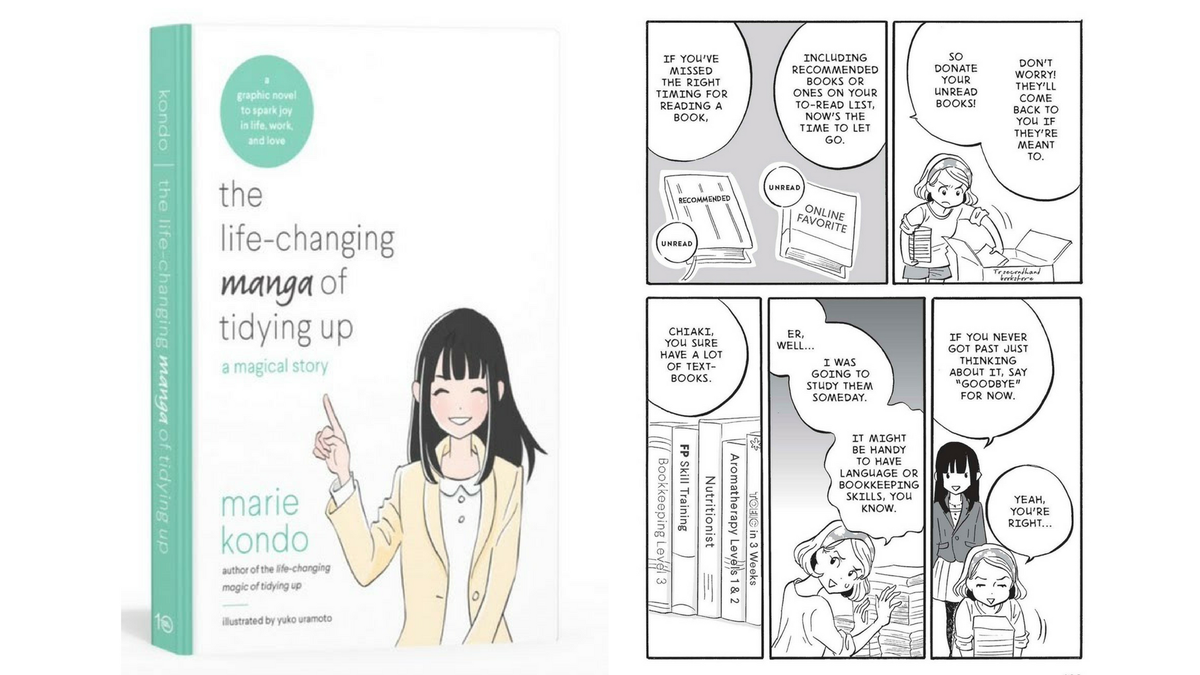

- Recommended Book- The Life-Changing Manga of Tidying Up by Marie Kondo: kick your last trace of lassitude and reduce bouncing back to a ghost-town of a messy home with this perfect guide for de-cluttering your surrounding, organizing yourself and internalizing the joy of inhabiting a warm, clean nest you call your home. The book soils Kondo’s promise to bring the immaculate side of your life out to your family. If a little twisting of your waist while tidying up can save your mom’s high-energy vibrational scolding, then this book is a saviour for your ears. As they say, you need to start seeing the world from your room – a little space but the only space on earth that is always under your administration.

- Recommended Movie: The Patriot Act – If you have smashed the subscribe button on the patriot act already, then scroll ahead. If you haven’t, this is going to sound like a sales pitch but, “just do it!” Setting aside the Nike reference, which Hasan Minhaj is always reppin on his show, he is perhaps one of the few sane voices on the internet in a moment such as this. Watch the episode where he dissects insidious racism which, he mentions, has not even escaped Indian households. His take on a deceptive tax returns start up and the convoluted tax filing process is packed comprehensive analyses and interspersed with hilarity.

- Search Myspace songs. In 2018, MySpace lost over 50 million music tracks in a botched server migration. A team of researchers recovered half a million of them and put them in this searchable database

Bonus: don’t try to solve it; just paste this equation on Google and hit enter.

(sqrt(cos(x))*cos(999999999999999999999999999999999999999999999999999 x)+sqrt(abs(x))-0.7)*(4-x*x)^0.01, sqrt(9-x^2), -sqrt(9-x^2) from -4.5 to 4.5

YOU SHOULD KNOW

- Making a great first impression is essential. Be it your sales call, interview, or the first day at a job, the first impression goes a long way in establishing your reputation. Some pro-tips on this include that you should have done your homework before a meeting, one should be exuding confidence, make deliberate attempts to engage but being a great listener at the same time. Also, do not forget to follow up with a thank you note or a mail.

- Bootstrapping is a common word in the startup world that commonly means to make your startup survive and thrive from your own money or from the generosity of friends and family. In a bootstrapped startup one’s resources are limited but the owner has 100% equity and decision-making power. Every entrepreneur should make a bootstrap plan in the young days of his startup.

- Racism has taken the world by a storm with revelations everyday of how deeply ingrained racial discrimination is among the workplaces. Last week, Type Director’s Club of the most prestigious and exclusive design organization shut down 2 days after a board member submitted his resignation calling out that the Club was a “racist organization”.

MORNING TEA CHALLENGES

- Maintain a Gratitude Journal – The health benefits of expressing gratitude are many- reducing stress, increasing positivity, better sleep, etc. There are three steps in pursuing gratitude – notice the good things in life, savour the feeling of gratitude, and express gratitude (to yourself and others). Start a gratitude journal by writing down good things that happen to you each day, and with time you’ll see the happiness quotient rise.

- Guided Imagery is a stress management technique which, with practice, can quickly calm your body and relax your mind. You can use your own imagination, or a guided recording, to find your happy place – like walking at the beach while the waves glance across your feet, eating your favourite meal, or winning a lottery, whatever you want. So here’s how to go about it – choose a scene, take deep breaths, immerse yourself in the sensory details (touch of water, snowfall, tasty food), and relax.

Written by Kumar Sourav Mohanty, Akansh Bhatt, Piyush Vijayan and Shashank Dobhal.